Liability owner’s capital and revenue accounts normally have – Liability owner’s capital and revenue accounts are fundamental components of accounting, providing insights into a company’s financial health and performance. Understanding their relationship and impact on financial analysis is crucial for stakeholders and decision-makers.

This comprehensive guide delves into the intricacies of liability owner’s capital and revenue accounts, exploring their accounting principles, types, and methods of calculation. It also examines the financial statement presentation and impact on financial analysis, equipping readers with a thorough understanding of these essential accounts.

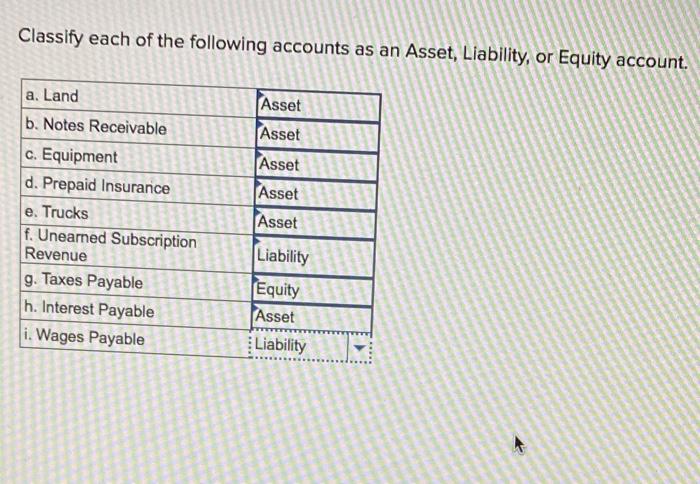

Liability Owner’s Capital and Revenue Accounts

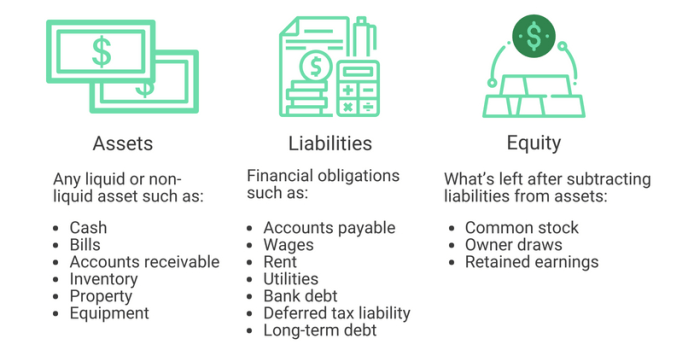

Liability owner’s capital and revenue accounts are two important financial statement components that provide insights into a company’s financial health and performance.

Relationship between Liability Owner’s Capital and Revenue Accounts

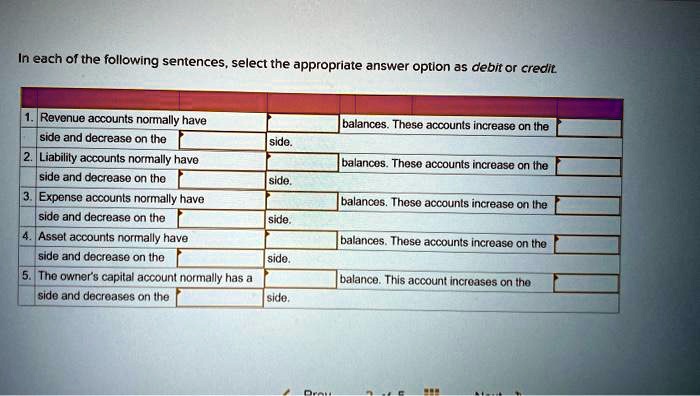

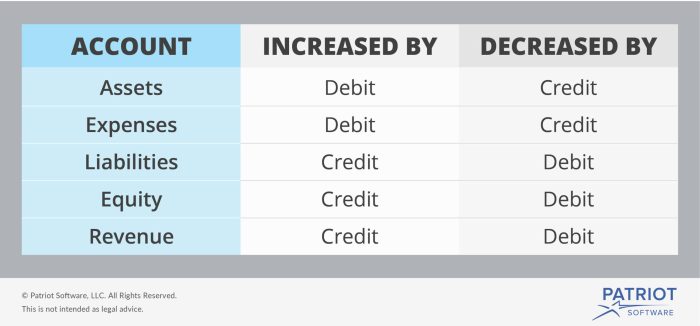

Liability owner’s capital represents the residual interest in the assets of a business after deducting its liabilities. Revenue accounts, on the other hand, record the income generated by a company’s operations.

There is a direct relationship between liability owner’s capital and revenue accounts. Revenue increases liability owner’s capital, while expenses decrease it.

Transactions Affecting Liability Owner’s Capital and Revenue Accounts

- Sales transactions increase revenue accounts and liability owner’s capital.

- Purchase of inventory increases liability owner’s capital and decreases revenue accounts.

- Payment of expenses decreases revenue accounts and liability owner’s capital.

- Receipt of loans increases liability owner’s capital and liabilities.

- Payment of dividends decreases liability owner’s capital and cash.

Accounting for Liability Owner’s Capital

Accounting Principles

Liability owner’s capital is recorded in the equity section of the balance sheet. It is typically divided into several subaccounts, such as contributed capital, retained earnings, and treasury stock.

Types of Liability Owner’s Capital Accounts

- Contributed capital: Represents the amount of money invested by owners in the business.

- Retained earnings: Represents the accumulated profits of the business that have not been distributed to owners.

- Treasury stock: Represents the shares of a company’s own stock that have been reacquired and held by the company.

Methods for Calculating Liability Owner’s Capital

Liability owner’s capital can be calculated using the following formula:

Liability Owner’s Capital = Assets

Liabilities

Accounting for Revenue: Liability Owner’s Capital And Revenue Accounts Normally Have

Accounting Principles

Revenue is recognized when it is earned, regardless of when cash is received. It is typically recorded in the income statement and classified into various categories, such as sales revenue, service revenue, and interest revenue.

Types of Revenue Accounts, Liability owner’s capital and revenue accounts normally have

- Sales revenue: Represents the revenue generated from the sale of goods or services.

- Service revenue: Represents the revenue generated from the provision of services.

- Interest revenue: Represents the revenue generated from interest-bearing investments.

Methods for Recognizing Revenue

There are several methods for recognizing revenue, including:

- Sales basis: Revenue is recognized when the sale is made.

- Installment basis: Revenue is recognized as payments are received.

- Percentage-of-completion basis: Revenue is recognized as work is completed.

Financial Statement Presentation

| Account | Balance Sheet | Income Statement |

|---|---|---|

| Liability Owner’s Capital | Equity | – |

| Revenue | – | Income |

Disclosure Requirements

Companies are required to disclose information about liability owner’s capital and revenue accounts in their financial statements. This information typically includes the following:

- A description of the liability owner’s capital accounts.

- A reconciliation of liability owner’s capital.

- A description of the revenue accounts.

- A breakdown of revenue by source.

Impact on Financial Analysis

Liability owner’s capital and revenue accounts are important inputs for financial analysis. They are used to calculate various financial ratios and metrics, such as:

- Return on equity (ROE)

- Gross profit margin

- Net profit margin

These ratios and metrics provide insights into a company’s profitability, efficiency, and financial risk.

Examples

For example, a company with a high ROE may be considered a more attractive investment than a company with a low ROE. Similarly, a company with a high gross profit margin may be considered more efficient than a company with a low gross profit margin.

FAQ Insights

What is the relationship between liability owner’s capital and revenue accounts?

Liability owner’s capital represents the owner’s investment in the business, while revenue accounts record the income generated from operations. Revenue increases the owner’s capital, while expenses reduce it.

How do transactions affect liability owner’s capital and revenue accounts?

Transactions that increase revenue, such as sales, will increase the owner’s capital. Transactions that involve expenses, such as purchases, will decrease the owner’s capital.

What are some examples of transactions that impact liability owner’s capital and revenue accounts?

Sale of goods or services: Increases revenue and owner’s capital.

Purchase of inventory: Decreases owner’s capital.

Payment of expenses: Decreases owner’s capital.